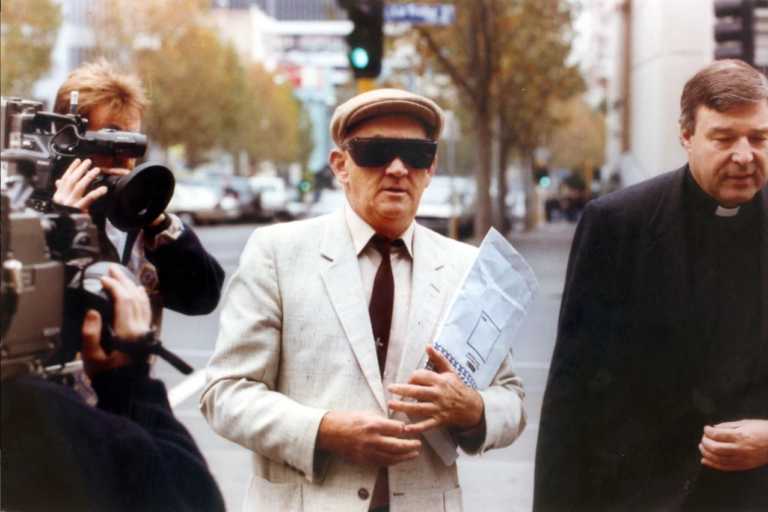

Gerald Ridsdale Update: Further Criminal Charges

Australia’s most prolific paedophile priest, Gerald Ridsdale, is now facing a further 62 child sexual abuse charges. Ridsdale was a Catholic priest who committed many

All the latest news on institutional abuse; including clergy abuse, defence force abuse, and foster parent abuse

Australia’s most prolific paedophile priest, Gerald Ridsdale, is now facing a further 62 child sexual abuse charges. Ridsdale was a Catholic priest who committed many

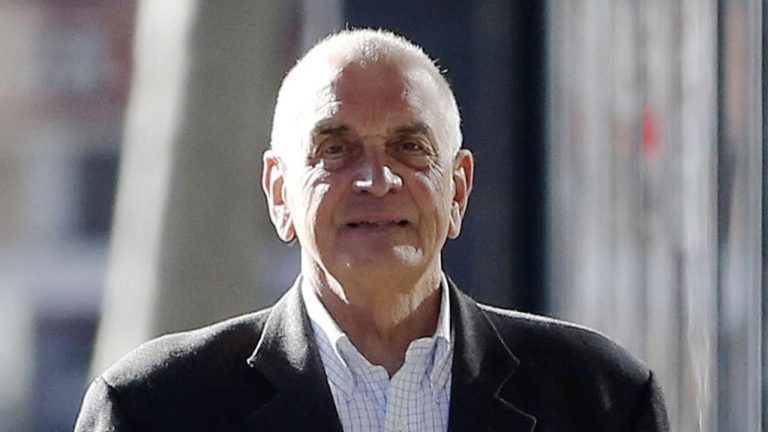

Disgraced paedophile and former Anglican Dean of Newcastle Graeme Lawrence will be released on parole next week. Lawrence was convicted of the 1991 sexual assault

Kelso Lawyers are seeking contact from people who have any information regarding Paul Raymond Evans (formerly known as Brother Evans or Father Evans) during his

As written by the founder and principal of Kelso Lawyers, Peter Kelso As a former State Ward and long-term advocate for victims of child abuse,

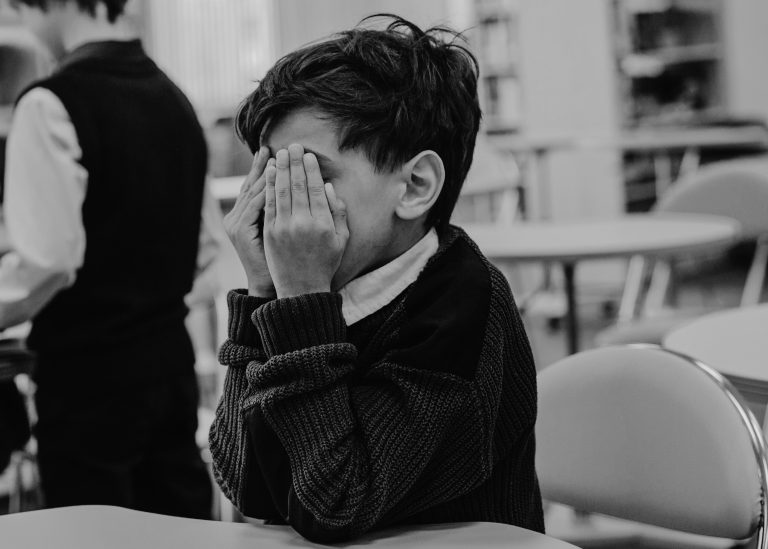

School should be the one place where all children feel safe. Sadly, for thousands of Australian students, this is often not the case. Students all

A recent independent inquiry into responses to child sexual abuse in Tasmanian schools found that the State spent decades protecting paedophile teachers and ignoring complaints

Kelso Lawyers are seeking contact from people who attended Chelsea Primary School (Victoria) in or around 1977. We are looking for ex-students who may have

Following the Royal Commission into Institutional Child Abuse, a number of changes were made to make it easier for abuse survivors to pursue compensation for

For many decades, ‘State Ward’ was the title given to children removed from their parents and assumed into the care of the State Government. Essentially,

Kelso Lawyers are seeking contact from people who attended Hendon Primary School in South Australia from around 1990-1994. We are looking for students who may

As written by the founder and principal of Kelso Lawyers, Peter Kelso It was with great satisfaction that I received the news in March 2023

The statistics surrounding pedophile priests in Western Australia are alarming. The Royal Commission into Institutional Responses to Child Sexual Abuse found that, between 1950 and

As written by the founder and principal of Kelso Lawyers, Peter Kelso As a former State Ward and long-term advocate for victims of child abuse,

Kelso Lawyers are seeking contact from people who attended Newcastle Secondary Junior Technical School between the period of 1958 to 1960. The school has undergone

Child abuse survivors are attempting to seize Catholic Church properties, including the Sydney Headquarters, to cover legal costs after their court bills went unpaid. The

Kelso Lawyers are seeking contact from former students of St Pius X High School in Adamstown who attended the school in the 1970s and 1980s.

Based on the information, interviews, complaints and quotes published by the Guardian in November 2022 In recent months, the Catholic Church in Australia has taken

WARNING: This article includes references to suicide which some readers may find upsetting. Reader discretion is advised. In 2017, the Royal Comission uncovered serious allegations

As written by the founder and principal of Kelso Lawyers, Peter Kelso I welcome the announcement of a state-run Care Leavers Redress Scheme for the

Kelso Lawyers are seeking contact from people who attended St Catherine’s School in Stirling, Adelaide, also known as Mt St Catherine’s Convent Boarding School, from

74-84 Tudor Street

Hamilton NSW 2303

Mail: PO Box 1016 Hamilton NSW 2303

t: (02) 4907 4200

f: (02) 4929 1188

e: adminteam@kelsos.com.au

Liability limited by a scheme approved under Professional Standards Legislation. Legal practitioners employed by Kelso Lawyers are members of the scheme. Click here for our Disclaimer and Privacy Policy.